how are rsus taxed in canada

The of shares vesting x price of shares Income taxed in the current year. The general rule is that the full amount of this taxable benefit is included in income and subject to tax in the year the option is exercised and shares are acquired.

Rsu Taxes Explained 4 Tax Strategies For 2022

When granted RSU is taxed as income.

. If you sell your RSUs on vest date. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Tax at grant for RS.

RSUs generate taxes at a couple of different milestones. But first a brief review on restricted stock unit taxation. RSU tax at vesting date is.

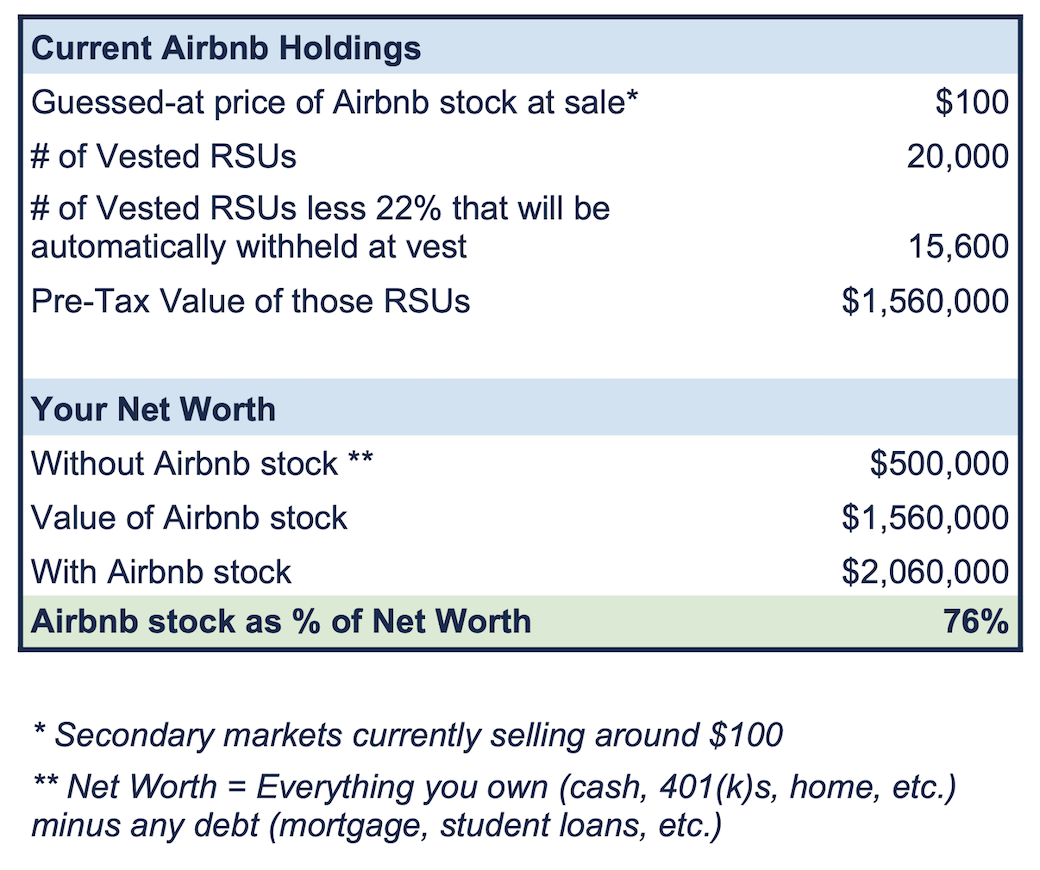

For most employees the taxation of their employment income is straightforward since their income is mainly comprised of salary and bonuses. Taxes must be withheld by your employer and remitted to the Canada Revenue Agency CRA. If held beyond the vesting date the RSU tax when shares are sold is.

RSUs are effectively deferred employee bonuses. If the RSUs or PSUs are settled. Generally tax at vesting for RSU.

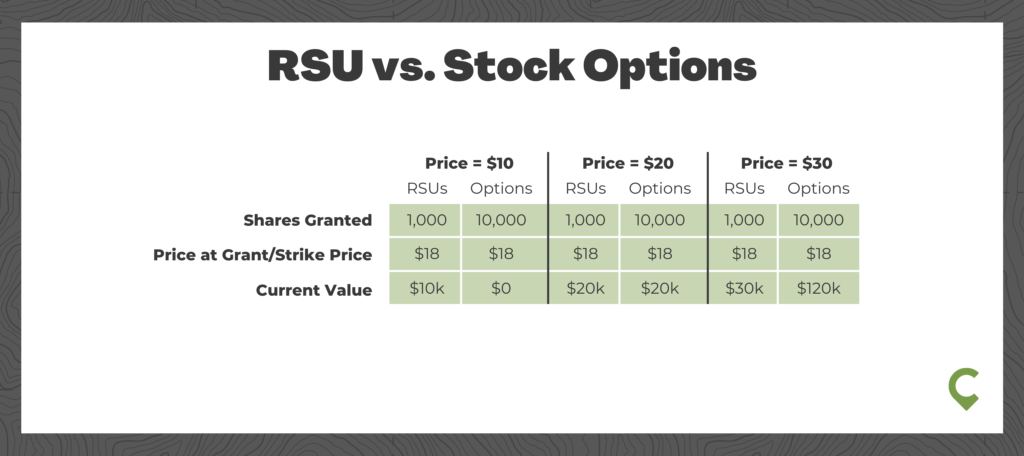

The year of receipt equal to the value of the RSUs or PSUs. Ordinary income taxes at vesting and capital gains. If you are awarded RSUs each unit represents one share of stock that you will be given when the units vest.

When vested the price difference is taxed as capital gain which count as 50 income. An RSU has little or no value until the vesting restrictions conditions have been achieved. Unless specific facts and circumstances support otherwise the.

The Canada Revenue Agency CRA has issued new commentary 1 with respect to taxation of restricted stock units RSUs. Taxable amount is fair market value of the shares on the tax event. At the time of vesting the FMV of the RSU grants that vested is considered as.

Ordinary Income Tax. The day your RSUs vest you will be taxed on them as regular income. If RSUs are settled in cash or can be settled in.

For example your marginal tax rate is 30 you got. What you do when they vest will determineif capital gains comes into play. Once when you take ownership of the shares usually.

Like stock options there are no tax implications when RSUs are granted to an employee. Capital gains tax is imposed only if the stockholder. If you receive restricted stock units RSUs as part of your compensation at a public company youll pay taxes twice.

Restricted stock and RSUs are taxed as wages upon delivery and subject to progressive income tax up to approximately 57 percent. Heres the tax summary for RSUs. The gain from the sale of shares is subject to tax as.

How are RSUs Taxed. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSUs can trigger capital gains tax but only if the.

Most have two options. Sell to cover where they sell RSUs to cover predicted tax as you said around 55 Pay taxes separately where you get all RSUs and are expected to pay CRA. November 3 2011.

When the RSUs vest when youre able to sell them youll receive a taxable benefit equal to the value of the shares received or cash. At the time the RSUs vest the employee is typically provided with shares and a. RSUs are taxed at ordinary income rates when issued typically after vesting.

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc

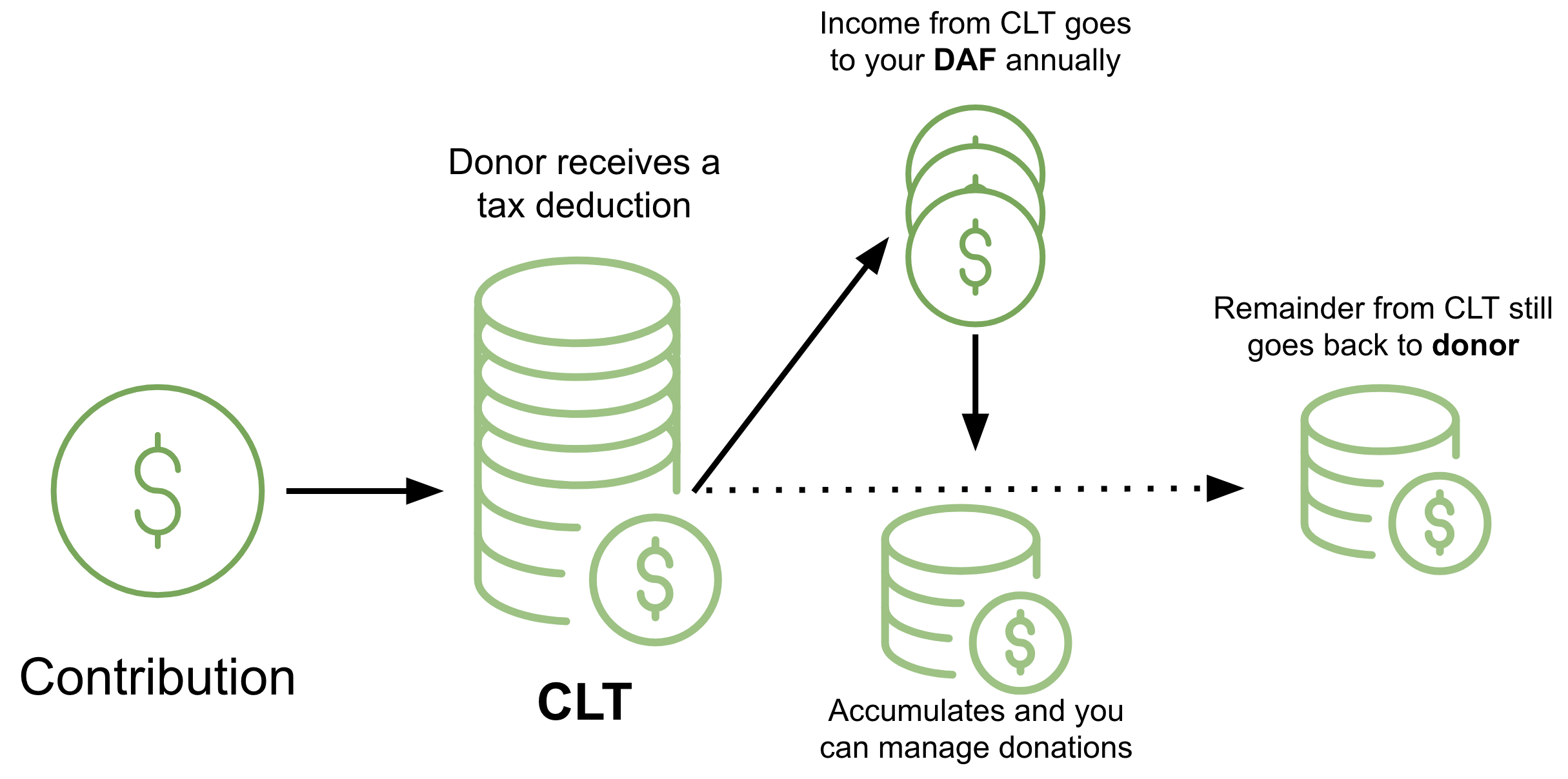

How To Avoid Taxes On Rsus Equity Ftw

Tax Deductions For Employer Owned Stocks Rsus Stock Options Espps Turbotax Tax Tips Videos

.jpg?width=920&name=GTN_Canada%20(1).jpg)

New Canada Revenue Agency Position On Restricted Stock Units

Us And Canadian Compensation Issues For Emerging And High Growth Comp

Taxation Of Stock Options For Employees In Canada Madan Ca

The Blunt Bean Counter Punitive Income Tax Provisions

Canada Taxation Of International Executives Kpmg Global

Rsa Vs Rsu Everything You Need To Know Global Shares

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Ltip Beyond The Mainstream Alternatives

How To Avoid Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

:max_bytes(150000):strip_icc()/woman-filing-income-tax-online-1091896434-bc9cf8a1a90942ec9283eb091975acde.jpg)