straight life annuity payout

With this option you can enjoy the benefit of receiving a lifetime payout from a straight life annuity while also having the option to leave unused premium payments to a. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

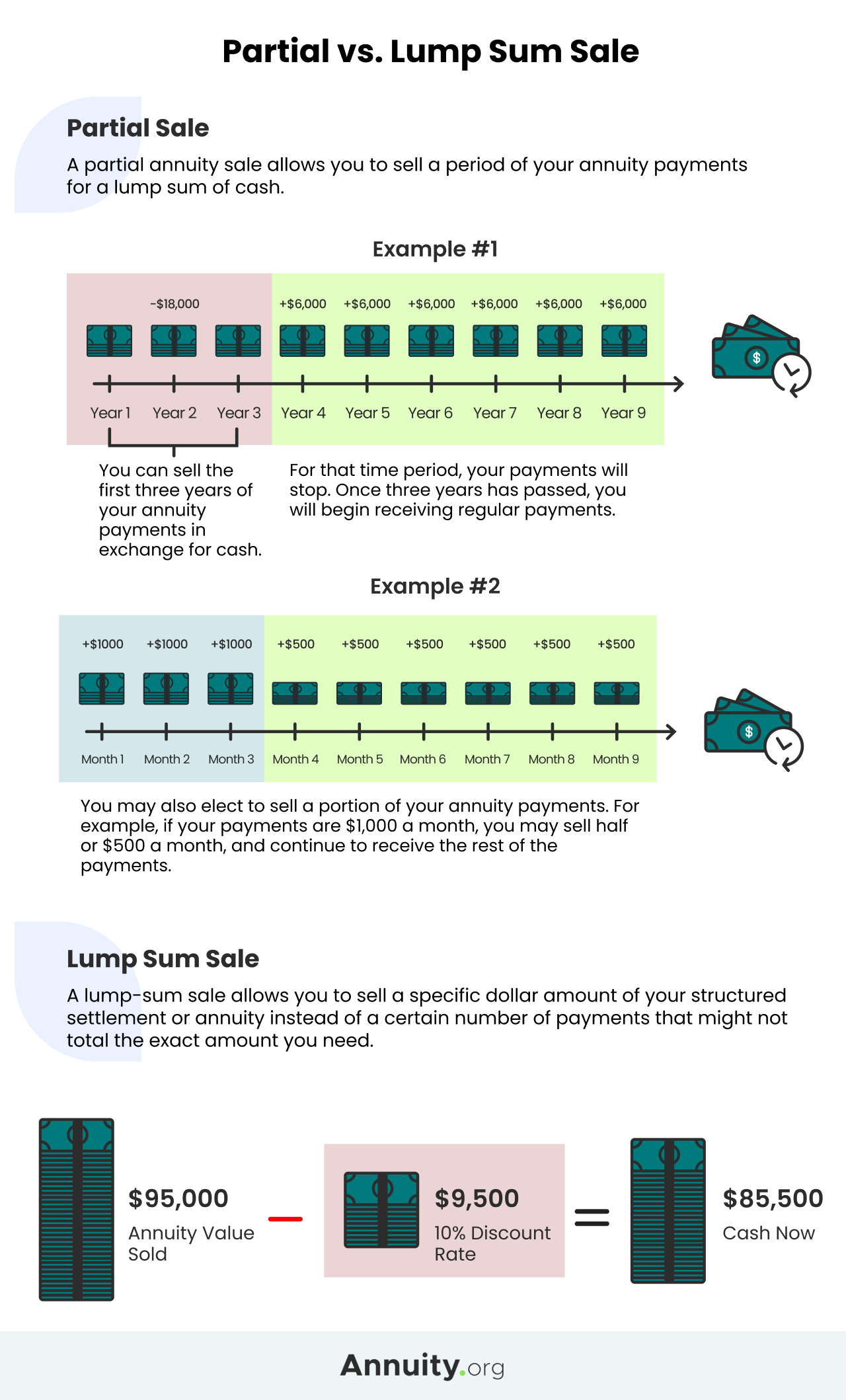

When Can You Cash Out An Annuity Getting Money From An Annuity

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

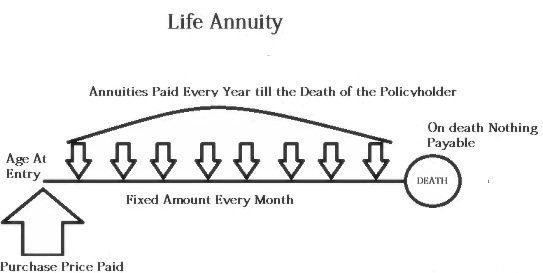

. The table gives maximum guarantee amounts for the two most common forms of annuity. Straight life annuities unlike permanent life insurance do not provide a death payout to your beneficiaries. A straight life annuity provides a guaranteed income stream until the death of the annuity owner.

As a result the annuity business can offer bigger payout. A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes any. Ad A smarter way to execute your indexed annuity strategy.

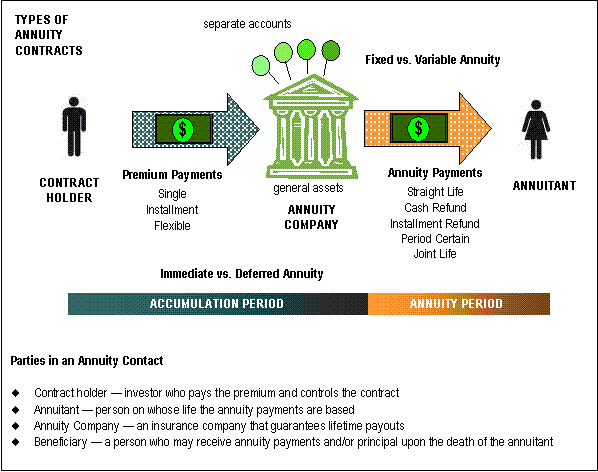

You may at first notice something we pointed out. Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the annuitant lives. With no payouts after the owners death this means that heirs beneficiaries and.

A straight life retirement annuity means that the retiree will receive a monthly annuity payment for as long as she lives and then the payments stop. The original premium is 192000 and a couple of products have a bonus while two others simply have higher payout rates. It depends on the form of annuity in which you receive your benefit.

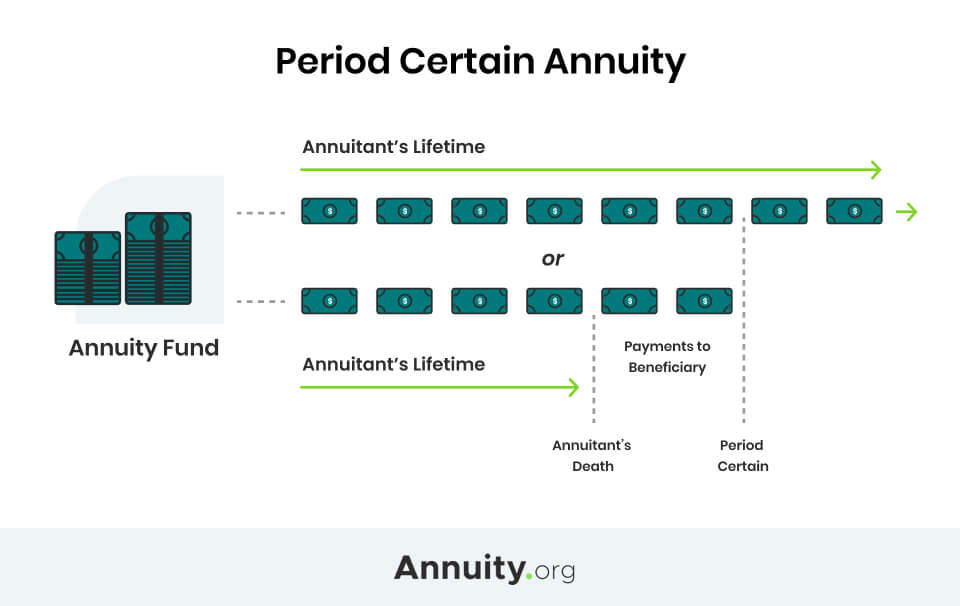

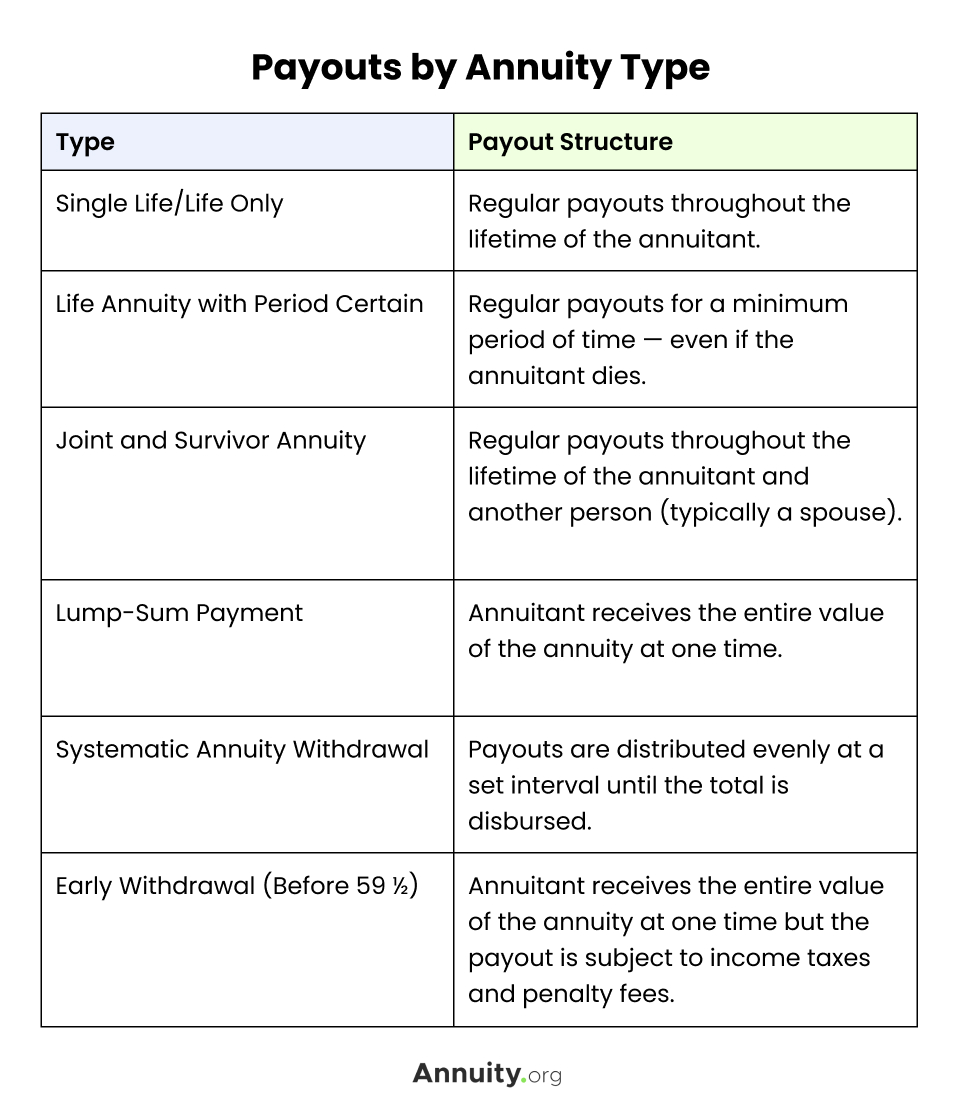

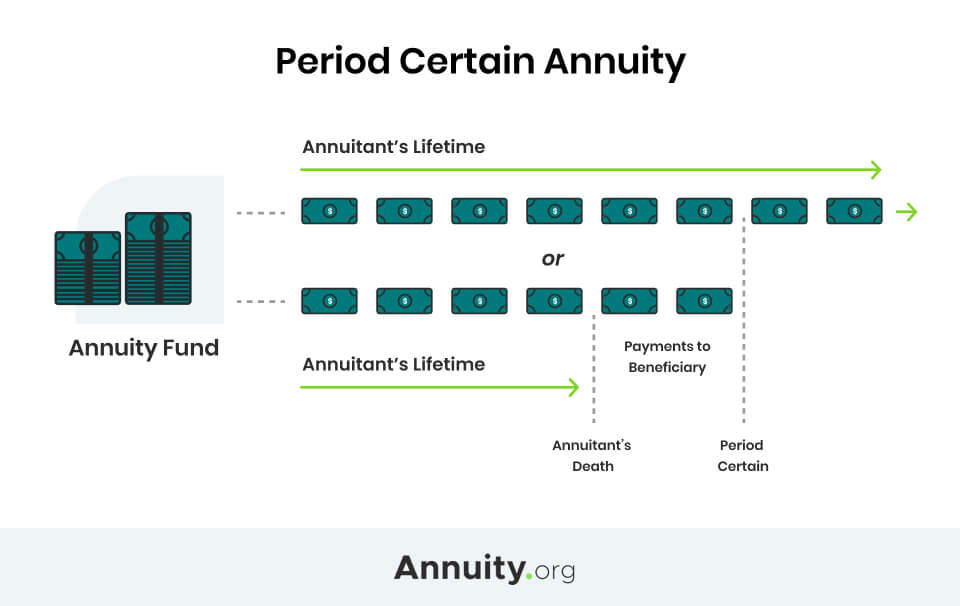

Straight life annuities do not pay out to payments. A lifetime annuity guarantees payment of a. A fixed-length payout option also known as fixed-period or period certain payout allows annuitants to select a specific time period over which the annuity payments are guaranteed to.

They stop paying when the annuitant dies. They payout until you die at which point the payments cease. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

When you annuitize your annuity on a straight lifelife-only basis you receive a guaranteed stream of income for the rest of your life. A lifetime annuity is a financial product you can buy with a lump sum of money. What Are The Straight Life Annuity Payout Options.

A straight life annuity is tax-advantaged just as other annuities. You will get income for your entire lifeeven after all the money you put into the annuity has been used up. In return you will receive income for the rest of your life.

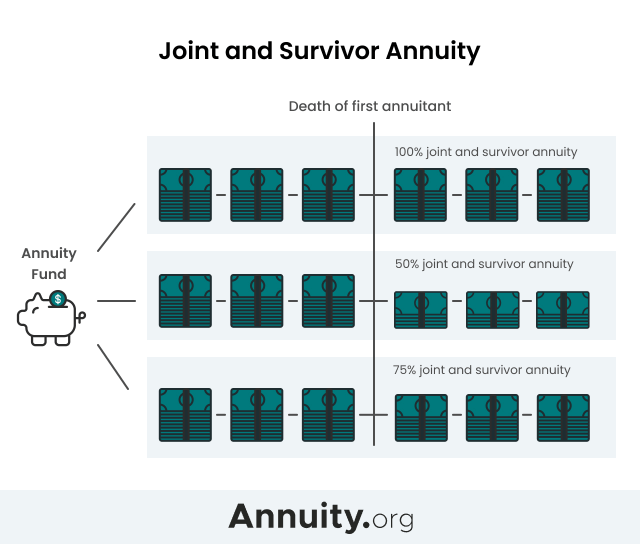

Like other annuities a straight life annuity guarantees a stream of income for a set amount of time. Get this must-read guide if you are considering investing in annuities. However with this payout option the beneficiary will.

With this option you can enjoy the benefit of receiving a lifetime payout from a straight life annuity while also having the option to leave unused premium payments to a. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. What makes a straight life annuity stand apart is that it pays out only while the annuity.

Straight Life Annuity Definition

What Is A Straight Life Retirement Annuity

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Understanding Annuity Payout Options Shootin It Straight With Stan

When Can You Cash Out An Annuity Getting Money From An Annuity

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Straight Life Annuity Everything You Need To Know

What Is A Straight Life Annuity Retirement Watch

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Period Certain Annuity What It Is Benefits And Drawbacks